Disclaimer: This post contains affiliate links.

There’s been several times throughout my life where I’ve had to figure out how to raise money in a short amount of time. Saving $10,000 for most people is a big goal. Let alone trying to do it in 6 months.

But this can be achieved by using a strategy and tactics that’s suited to your lifestyle.

By the end of this post, you should know where to start, and have an idea of how to reach the $1, $100, and $1000 milestones to help you stay on track to reach your $10,000 goal.

Skip to section

Having positive cashflow is key!

The first thing you need to establish is if you are in a financial position that is cashflow positive or cashflow negative. If you are cashflow positive, you are receiving more income than expenses. If you are cashflow negative, you have more expenses than your income.

Make a list of your current income and expenses to establish your current financial position.

If you are cashflow negative, you will need to implement tactics to first become cashflow positive, and then methods to grow and scale the amount of positive cashflow so you will be in a position to save more money.

How much positive cashlow will you need to save $10,000 in 6 months?

The amount that is needed to save $10,000 is the following.

| Timeframe | Amount |

| Per Day | $59.52 |

| Per Week | $416.67 |

| Per Month | $1666.67 |

To keep yourself accountable to these saving amounts, you can setup a direct debit for these amounts in your bank account. As long as the money is in the account that will be debited and you don’t spend the money that you are saving, you will save $10,000 in 6 months.

If you want to try to grow the money that you are saving even more, you can setup direct debits via microinvesting apps. A few that you can consider are:

- Acorns

- Raiz

- Spaceship

Also consider using this online savings calculator to help with planning your savings.

Should you focus on minimizing expenses or earning more income?

In my experience, you will be in a better position if you focus on earning more income. I do believe you need to manage your expenses and remove or reduce wasting money as much as possible. However, you will be likely to earn much more than you save.

Also, there are unexpected expenses that always occur. For example:

- Inflation on the cost of goods. (There are several countries that have experienced a 5-20% increase in inflation in the last 2 years.)

- Health emergencies.

- Lifestyle expenses.

- Unexpected events or costs.

If you have a credit card, you will need you need to manage your monthly balance to avoid accruing excess fees. (Try using this credit card budgeting tool to manage your credit card expenses.)

How much should you aim to earn per day?

A minimum of $200 a day is ideal. But the more that you can make, the better.

Depending on where you live, around 1/3rd will go towards tax. Then at least another 1/3rd will go towards your living and lifestyle expenses.

You can use this budget planner to help manage your cashflow and expenses.

What other things can you do to help you make more money?

Ask for a raise in your job.

If you are employed, ask your employer if they can increase your wages so you can earn more hourly, daily, weekly, or monthly.

Get a 2nd job

You will usually have the opportunity to work up to 16h in the day. (That’s a lot). Or if possible, 12h.

So you can earn an hourly wage for your time to raise the extra money to hit your $10,000 goal.

There are usually warehouse jobs that require staff to work on a 24h roster. It’s possible to earn extra income as a casual and work a 4-5h shift.

If you are in Australia, it is possible to earn $20-30AUD per hour for this shift. So that can be an extra $100AUD per day at least for the work that you do.

There are several other jobs that you can also consider in a casual role such as:

- Waiter/Waitress

- Bar staff

- Data entry

- Housekeeping

- Receptionist

- Sales assistant

- Pick packers

- Courier Drivers

- Valet Driver

- Cabin Crew

- Cleaner

Start a side hustle

There are several ways to earn an income doing a side-hustle outside of your regular job. Ideally, you want to earn upwards of $100 a day or more, which will give you an extra $3000 per month.

There’s a couple of options that you can consider.

Sell stuff

The quickest way to make more money is to sell products or services to people and command your own earning potential by setting the price that you want.

Facebook marketplace

I’ve managed to sell used items through Facebook marketplace to raise extra funds. Depending on where you are located in the world, you will be able to list items for sale and people will pay to collect those items from you.

I managed to make an extra $150AUD in my first month, which helped with being able to cover a few expenses.

Craigslist

You can list items for sale on Craigslist and start earning extra money.

Gumtree

It’s been a while since I’ve sold something on Gumtree, but I had the most success with the platform selling in London in the United Kingdom just before emigrating abroad.

Ebay

You can list items on Ebay to sell for a fixed price or via an auction.

Get free stuff that you can sell and make money.

Look for items that’s unwanted and see if you can flip it on a marketplace to earn some extra money. As the saying goes, one man’s trash is another man’s treasure.

Earn with Cryptocurrency

If you sign-up to Coinbase, you can get $10 worth of free Bitcoin.

Click here to get your free Bitcoin.

Affiliate marketing

I’ve spoken about affiliate marketing in a few of my other posts. But you can get started by promoting products on the web in exchange for a commission. This doesn’t require any upfront costs as long as you can get on a platform and promote the affiliate links and drive traffic and lead or sales conversions via your affiliate link.

You want to find affiliate programs with a good converting offer and ideally a high commission rate. This will allow you to make the most amount of money through the program. And in most cases, you will be able to get paid through via Paypal, check, or a direct deposit into your bank account.

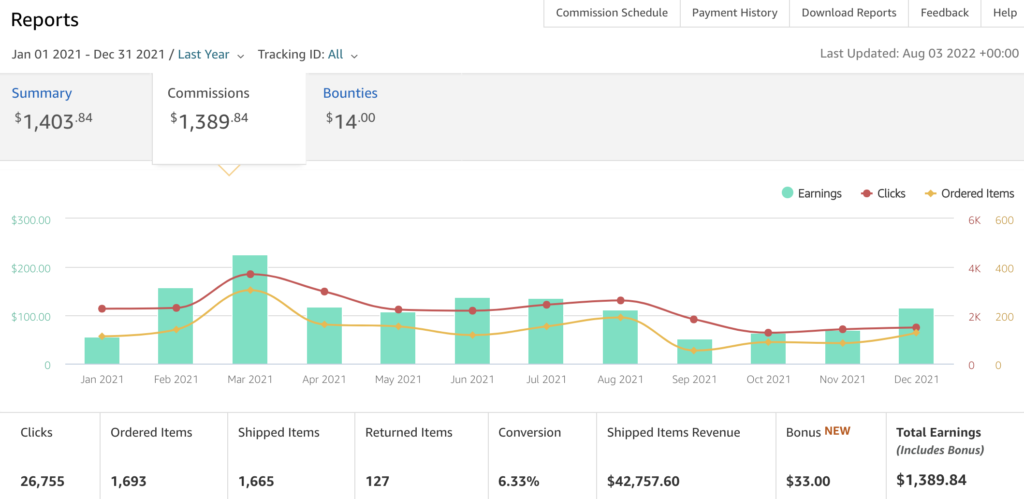

Below is a snapshot showing some of the earnings I made with Amazon’s affiliate program.

What are some of the affiliate marketing programs that you can join?

This pays $5 per referred user or 10% of earnings for people that share their unused internet data/bandwidth. A person could earn anywhere from $20-40 per month from unused data on their phone or home internet.

Influencer marketing

There are a few influencer marketing sites that will pay you to promote products, services, or awareness for a post to your influencer audience. At the moment, there’s demand for influencers that have followings on TikTok, Instagram, Facebook, and YouTube. There are also blog influencers that can charge to publish a sponsored post on their site.

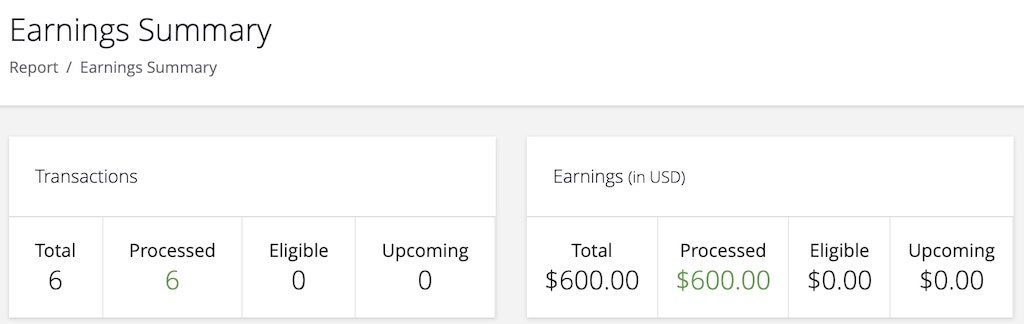

The influencer marketing platform that I’ve been able to make the most amount of money from to date is Intellifluence.

You can also check out my other post that shares more information about how to earn money as an influencer.

Click here to join Intellifluence as an influencer.

Ad networks

Ezoic

You can sign-up to Ezoic to earn income from advertisements on your website if you are already using Adsense. The difference is that the impressions are optimized so that you generate more income everytime an ad is shown on your website. It also displays better quality advertisers, so that you get paid a better rate per impression.

Click here to sign-up to Ezoic.

Flip selling

You can make quite a bit of money by flipping items that you find. From a few hundred dollars to a few thousand dollars.

A simple way to start is to find items that are being given away or disposed of for free. Or go to places where you can pick up bargains such as garage sales.

You can resell these items at your local markets for a small stall fee, or sell it on online marketplaces.

Gig Economy

There are several gig websites that allow you to post tasks that you can complete in exchange for money. I originally got started on Fiverr, but I’ve also had success with Airtasker.

One of the easiest ways to get started is to offer copywriting services on Fiverr.

You can click here to see an article on how to get started.

Make more money with any money that you already have saved.

If you already have money saved somewhere, that’s great! You just need to leverage the money that you have in a way so that it can make more money for you.

You want to do it in a way so that you will minimize the risk of losing any money. Or if you do, that you are able to make the money back quickly.

What are some of the options that you have?

Stocks and shares

You can earn extra income if you receive dividends from stocks and shares. You should only explore this option if you already have money that you can invest. Typically, you will receive 3-5% of the value of your stocks and shares.

If you have $1000 invested in stocks and shares, expect to get around $30-50.

You may also gain more money from the sale of your shares in the future by seeing an equity growth in the shares that you own.

The amount that you can earn varies. And there is a risk that you can lose money from the equity return as well; should you decide to sell.

Another thing is if you own stocks and shares, you can actually get a secured loan on these assets.

If you would like to start trading, consider using Interactive Brokers as they charge a low cost to process stock trades.

Click on this link to sign-up and get $1000 in free stock.

Sign-up to cashback offers

There are a number of sites and apps that can help you save money by offering cashback or discounts. Start by taking a look at your usual spending habits with your cards, and where you shop. Then look into any offers that will allow you to save money. These could be:

- Discount vouchers or coupons

- Cashback incentives

Sign-up to the following to start taking advantage of available offers.

Honey

Honey is a popular app that helps people find the cheapest deals on what they are looking for.

You can also earn cashback, which you can redeem with gift cards and contribute towards the $10,000 goal.

Click here to start saving and earning with Honey.

Raiz app

I have the Raiz app on my phone and it is connected to my card. So if there are any offers that are found in my daily transactions, it takes advantage of them in the form of rewards. Sometimes, this can be free cash added into my Raiz account.

Click here to get $5 for free when you sign-up to Raiz.

Earn money for walking

Because I exercise regularly and it takes up at least 90 minutes of my day, it would be ideal to get paid for the time that I spend walking.

There are some activities and apps that you can use to earn a bit of extra income, and work towards your fitness at the same time.

Paid 2 Go

You can download Paid2Go and start earning up to $75 per month from walking. Roughly 20 coins is $1. And for this, you will need to accrue around 25,000 steps. The 7-day trial is free, however you will need to pay $149 per year for a subscription.

Click here to download the Paid2Go app and start earning money from walking.

Rewards cards

In Australia, I use the Woolworths rewards card regularly to save money everytime I shop in Australia. The app also allows you to add your other rewards cards (such as the Qantas app to help you get better deals on your flights).

Compounding interest/returns

Keep any money that you aren’t using at least in a compound interest savings account. This will help your bank balance grow.

Add any small change that you find into a jar.

Keep a jar close to you and collect any spare change that you find lying around. Add these into the jar. You’ll be surprised with how much you will accumulate over the course of 6 months.

How can you minimize your spending?

Eat non-processed or packaged foods.

People buy processed and packaged foods all of the time and don’t realise that they are paying a significant premium in price for their food and nutrient intake compared to if they focussed on consuming non-processed foods.

- Head to your local green grocer to buy fresh fruits and vegetables in bulk.

- Consume lean protein (E.g. Lean meats)

- Eat healthy fats such as avocados.

You should be able to spend between $3-5 per meal.

Use the following resources to help with shopping and recipe ideas.

Reduce your entertainment costs.

Entertainment costs rise quickly and can accumulate unexpectedly in the moment. You should have fun in your life, but if you prioritise entertainment that is free or inexpensive, you will be able to save alot more money.

There are a few activities that you can consider.

- Play outdoor activities.

- Meetup to eat and drink at parks and beaches.

- Take part in adventure areas that’s open to the public. Such as trails for hiking and cycling.

Reduce eating out.

It’s much cheaper to eat inside in most countries. In Australia, you can expect to spend $15-50 per person for a single meal. Doing this even 2 times a week can easily make you break $100 a week in spending. Over 6 months, that’s an extra $2600 that could have been saved.

If you enjoy eating out, I suggest being savvy and maybe limiting eating out to once to twice a month. Or prepare food at home.

Zero-waste, minimalist & sustainable lifestyles.

I’ve found that you can reduce your expenses by adopting more of a zero-waste and minimalist lifestyle. I’d originally started to learn more about these lifestyles through online content and videos such as the one below.

The habits adopted force you to refuse, reduce, reusing, recycle, and items that can go back into the environment (e.g. biodegradable).

I also learned that it’s better to leverage technology and systems that can improve your habits. For example, if you want to cut down on electricity consumption, you will want to use technology that doesn’t rely heavily on energy consumption.

A couple of examples include:

- Replace incandescent light bulbs with energy-efficient LED lightbulbs, which can save you up to 80% on your lighting costs.

- Replace commuting to your destinations in a car either by walking, cycling, skating, using a scooter, or another self-propelling device.

- Use more natural light rather than artificial light inside your home.

- If you need heating, use hot water bottles and warm clothing (wool or fleece) to keep your body warm and reduce your reliance on energy consumption.

- Avoid using metered hot water where possible.

Final thoughts.

Saving up money can seem like a challenging goal. But with the right strategy and tactics, you will be able make steady progress and save up towards your goal to save $10,000 in 6 months. Keep in mind to:

- Always maintain positive cashflow

- Set and stick to your goals, strategies and tactics.

- Multiply the money that you already have. Make the money work for you!

- Create as many streams of income as possible. (Aim for at least 6)

- Minimize your spending costs

- Setup automated weekly deposits to commit to your savings goals.

If you have tried to save $10,000 in 6 months, share your story. Whether you succeeded or not, we would love to hear about the effort that you put into working towards your savings goals.

Good luck!

Sign-up now!

Start your digital nomad journey today!